The First Level 3 Pilates Date of 2025

🎉 NEW YEAR, NEW CAREER! 🎉✨ Transform Your Passion for Pilates Into a Professional Career in 2025! ✨ Our first course date of 2025 is

Instructor Newsletter 19th Jan

Good Morning

How are you ?

Have you booked the amazing Women On Fire

Event – Its going to be amazing click here for details.

Do you want to come to Ibiza for the YogaFit

Retreat in April?

Ill be teaching and the flights are cheap cheap cheap.

Click here for details and the code to get a 5% discount

is YOGAFITRACHELHOLMES

After Lindsay Gillam’ amazing Kick Start launch last week

with 140 people I am looking for more Franchisees

there is so much opportunity with our new programmes

email me for details.

Last chance to get the Fitness Pilates For Back Care

Online Certification at the discounted rate click here

My TOP 61 TIPS For Being A

Better Fitpro to make our January 2017

career wise AMAZING.

Let me know which ones you agree with.

1: Attend EVERY course you can possibly afford on all fitness related subjects – LIVE & Online.

2: Attend ALL conventions, events, trade shows to learn & network. Knowledge is KING.

3: READ EVERYTHING you can get your hands on – fitness/productivity/time

management/Business/Wellness/Spirituality/Positivity/nutrition.

4: BE YOU – Stop trying to be someone else.

By all means have role models

& model yourself on successful people, but YOU Do YOU.

5: You won’t make A HUGE amount of money teaching face to face classes long term. Trends will come & go with the potential to earn short term, but if you follow trends you have to keep

jumping on the next one.

6: Immerse yourself in e-commerce – Learn WordPress / Learn to update your own website/Digital is the way forward to expand your business.

7:Your Website is your digital home.

Be house proud!

Make it professional, not cheap

& nasty.

8.Understand Facebook -Its here to stay.

9: Learn to say NO – Get a fast track ticket to “JUST SAY NO TRAIN” for your

own health, wealth, life and SANITY.

10: Stop being a people pleaser.

11:Learn to meditate.

12: Choose happiness & positivity every day possible.

13 Get interested in the law of attraction, manifestation & quantum physics.

14: Charge more & don’t be the cheapest.. EVER.

15: Listen to your girlfriends – what they talk about, problems & issues they have.

16: If women are your main audience, then read women’s media, magazines, blogs, podcasts – immerse yourself in female culture if women are your business.

17: Only teach what YOU love. Teach things you don’t love & people will not come for very long.

18: Teach What You LOVE

19: A sustainable fitness business takes time to build. You have to put the spade work in.

20: Act as if you are the most successful person in your field and believe it.

21:Be kind to others, you haven’t walked in their shoes.

22: Get as fit & healthy as possible. Hire a PT / Train yourself / Eat Clean & walk the walk.

23: Delegate and Outsource – Pay a book keeper / accountant / PA if you need one and focus on doing the things you love, like teaching & training people & brainstorming new ideas.

24:Build your platform online so you can spread your message & serve more people. Your income is directly related to this.

25: Understand & use Facebook Adverts. Google ADWORDS & PPC if you want to grow an online business

26:Find a great graphic designer who understands you and your concepts. Branding/Posters/Leaflets digital or hard copy are VITAL to your success in building a bigger business.

27: Don’t take criticism personally & don’t let it set you back.

28: Reach out to new markets – Older/Younger/Overweight/Disabled/Kids/Families/ so many untapped & under serviced niches who need fitness etc

29: Write every day – The more your write the better you get.

30: Find PASSION in all you do. Passion is like a muscle, you don’t find it under a rock, you have to train your passionate muscles every day.

31: Take plenty of breaks / holidays /days out. Keep breaking up your weekly routines for inspiration & increased productivity.

32: Work out EXACTLY what your core values & core priorities are. Evaluate every week & manoeuver & change to keep on your true path.

33: Have a LIFE partner who has your BEST interests at heart. This doesn’t have to be your partner or spouse, someone who you can bounce your ideas around & talk things through honestly.

34: Never compare yourself to others; it’s the fastest way to negativity & giving up.

35: Embrace Change. Change is good.

36: If you are enthused & motivated by a team or group. Join a franchisee or work with a collective.

37: Before you embark on a project research every angle thoroughly. Calculate all risks before you spend money and go for it.

38: All Fitpros LOVE the idea of owning a studio. But I beg you to do the research & make sure your numbers add up before you commit to leases & purchasing property.

39: If you REALLY want to write a book hire an expert to help you.

40: Marketing plays a HUGE part in your success, like it or not.

41: Network digitally or in person with as many health professionals as possible – Drs/Nurses/GP’s/Massage/Therapists/Dietitians/Dentists

42: Find out what EVERYONE who comes to your classes does for an occupation. You’ll be amazed at the fantastic contacts you see every single day & probably don’t even realise it.

43:Stop trying to be all things to all people. Accept some people will like you and some will not. It’s life, there’s nothing you can do.

44: Get into juicing

45: Learn EFT – Tapping

46: Workout how much money you want to earn. Have a joyful relationship with money, understand your own self-worth & stop underselling yourself.

47: Live in the NOW/Present. Plan and Affirm but don’t miss out what’s happening in the now. Be present.

48: Even if you are a complete one man band see yourself as a business.

49: Be a customer – Take a fitness class / Yoga / Pilates class, be a beginner again at something fitness related.

50: GET IT OUT THERE – if you have an idea just get it out there. It doesn’t have to be perfect, you have to release it and perfect it afterwards. Don’t wait, you will never launch it.

51: Build your email list & grow it every single day. You do not have a business unless you have a list, no matter how small.

52: There are no get rich quick schemes in fitness.

53: Get into INSTAGRAM – Stop seeing these as time sucks, they are amazing ways to spread your message, your brand and your leverage.

54: VIDEO killed the radio star – Interview all of your clients, class members. Put yourself in front of the camera and get real people, saying real stuff about your classes & services, on Social Media, daily!

55: Create your own fitness apparel.

56: Put your Daily/Weekly/Monthly/Yearly in your iphone and LOOK at it all through the day. Stay focused on it and get the job done.

57: When you set your stall out to work at your desk, REALLY WORK. Don’t answer calls, text, watch apps, instant message, go on Facebook. Keep your head down for the time you allocate to the project and keep going. REALLY WORK.

58: Work on your daily affirmations & mantras.

59: Believe in YOURSELF & YOUR abilities 10000000%. It shows if you don’t.

60: Work Smarter NOT harder.

61: Guard your time with an iron will. Don’t waste a minute you cannot get it back.

Short. Sweet & To The Point

Add me on Instagram Rachel L Holmes

Facebook LIVE today at 8am BOOTCAMP

Living The Life of Riley….!!!!

By Andrew Crawford

I don’t know who Riley is but I felt like him this last week..!!

Apparently……I’m living the easy life..!!

Firstly kicking it off on Sunday was my appearance at the annual KSFL conference, where some Fine Female Franchicees of the popular KSFL brand….oh….and there were a few geezers in there as well (Yo Bros…!! (fist pump)) held their meeting discussing a wide variety of subjects, sipping on tea and chomping on food devoid of fat.

Bet on the way home some of them had a Mickie D’s..!!! …..tee hee

Then early fresh & misty Tuesday morning, before the Sun brushed it’s teeth, had me flying down the M1 motorway for a 2 day get together with some clever business operatives learning some fings useful for business.

This is unprecedented as I usually do not leave my desk in January….needless to say I was faced, tempted and cajooled with multiple offers of alcoholic beverages all evening….which I refused. It’s ‘Dry January’ ..(I was going to have dry white wine or dry gin but settled for good old J2O…!!). Even at the evening meal I was sipping on H2O…..I was living the life of Riley!!

No doubt I’ll be working my little ‘round spherical objects’ off for the next 2 weeks to catch up..!!

So Andrew,

What has Living the Life of Riley got to do with Accountancy & Tax?

Well…..To live like Riley you need to have enough resources to support your leisurely lifestyle, in order for that to happen you must have savings. This is whether you use the money saved with the top money launderers aka banks or you’ve slowly saved your hard earned dosh under your mattress, sock or other type of draw.

Otherwise, you can use money built up by other means. Usually pension

It just so happens that On Sunday I was asked a question by my Blond Bombshell friend from down South….Ms Danni Evans (Pssst……..she used to be dark….tee hee) but still fit and cute as…..wanting to know about personal pensions.

Personal pensions are pensions that you arrange yourself. They’re sometimes known as defined contribution or ‘money purchase’ pensions. You’ll usually get a pension that’s based on how much was paid in.

If you are employed some employers offer personal pensions as workplace pension.

The money you pay into a personal pension is put into investments (such as shares) by the pension provider. The money you’ll get from a personal pension usually depends on:

how much has been paid in

how the fund’s investments have performed – they can go up or down

how you decide to take your money

There are different types of personal pension. They include:

Stakeholder pensions – these must meet specific government requirements, for example limits on charges

Self-invested personal pensions (SIPPs) – these allow you to control the specific investments that make up your pension fund

You can either make regular or individual lump sum payments to a pension provider. They will send you annual statements, telling you how much your fund is worth.

If you’re a UK taxpayer, in the tax year 2016-17 the standard rule is that you’ll get tax relief on pension contributions of up to 100% of your earnings or a £40,000 annual allowance, whichever is lower.

For example, if you earn £20,000 but put £25,000 into your pension pot (perhaps by topping up earnings with some savings), you’ll only get tax relief on £20,000.

Similarly, if you earn £60,000 and want to put that amount in your pension scheme in a single year, you’ll normally only get tax relief on £40,000.

Any contributions you make over this limit will be subject to Income Tax at the highest rate you pay.

Since 2012, a system is being gradually phased in requiring employers to automatically enrol all eligible workers into a workplace pension. It requires a minimum total contribution, made up of the employer’s contribution, the worker’s contribution and the tax relief.

In the past it was up to workers to decide whether they wanted to join their employer’s pension scheme. But by 2018 all employers will have to automatically enrol their eligible workers into a workplace pension scheme unless the worker opts out.

Automatic enrolment is being introduced in stages up until 2018. The largest employers started first, followed by medium-sized and then small employers.

If you haven’t yet been enrolled in a scheme, your employer will tell you the exact date of it will begin automatic enrolment and whether or not you’re eligible for their scheme.

Whether you work full time or part time, your employer will have to enrol you in a workplace pension scheme if you:

are not already in a suitable workplace pension scheme

are at least 22 years old, but under state pension age

earn more than £10,000 a year (tax year 2016-17)

work in the UK

You can opt out of your employer’s workplace pension scheme after you’ve been enrolled. But if you do, you’ll lose out on your employer’s contribution to your pension, as well as the government’s contribution in the form of tax relief.

If you decide to opt out, ask the people who run your employer’s workplace pension scheme for an opt-out form. You must then return your completed form to your employer, not to the people who run the scheme.

If you decide to opt out within a month of being enrolled, any payments you’ve made into your pension pot during this time will be refunded to you.

After the first month, you can still opt out at any time, but any payments you’ve made will stay in your pension pot for retirement rather than be refunded.

Your employer is legally required to enrol you into a workplace pension scheme and to make contributions to it.

If your employer doesn’t have a pension scheme and is not sure what to do, they can compare some of the schemes on offer through a new website called Pension Solution. Pension Solution is run by the Pensions and Lifetime Savings Association (PLSA) which is an independent, not for profit organisation that represents workplace pension schemes.

If you make your spouse an employee of the company, then of course you’ll have to provide them with a workplace pension – which is great news for you both. You’ll be able to make pension contributions to them too and gain additional tax relief, and so boost retirement income for the pair of you.

If you have enough money in your SIPP (self-invested personal pension) you can buy the property in which you run your business and keep it inside your pension (you can borrow up to 50 per cent of its value to cover the cost). You then pay market-value rent to the SIPP itself. This puts a great investment (property) into your pension, while also saving on corporation and income tax, and also on capital gains tax when you sell the property.

Now….there’s so much other detail I could go in today, however I feel this is enough for you to understand the basics.

Finally

You have under 12 days in which to get your Return done online. Remember you also have to pay the tax by the 31st. If your tax affairs are straight forward and you do not wish to use an Accountant, perhaps you may look at this service:

www.quickzlogg.co.uk

Alternatively for the full version which includes invoicing, credit control, snap your receipt and much more, take a look here:

www.zlogg.co.uk

Andrew James Crawford

www.zlogg.co.uk

www.quickzlogg.co.uk

www.fitnessindustryaccountants.com

www.facebook.com/andrewjamescrawford

www.andrewjamescrawford.com

🎉 NEW YEAR, NEW CAREER! 🎉✨ Transform Your Passion for Pilates Into a Professional Career in 2025! ✨ Our first course date of 2025 is

January 2025 is PILATES Education Month We have ALL the courses running in January Fitness Pilates Teacher Training 3rd January Level 3 Pilates 10/11/12 January

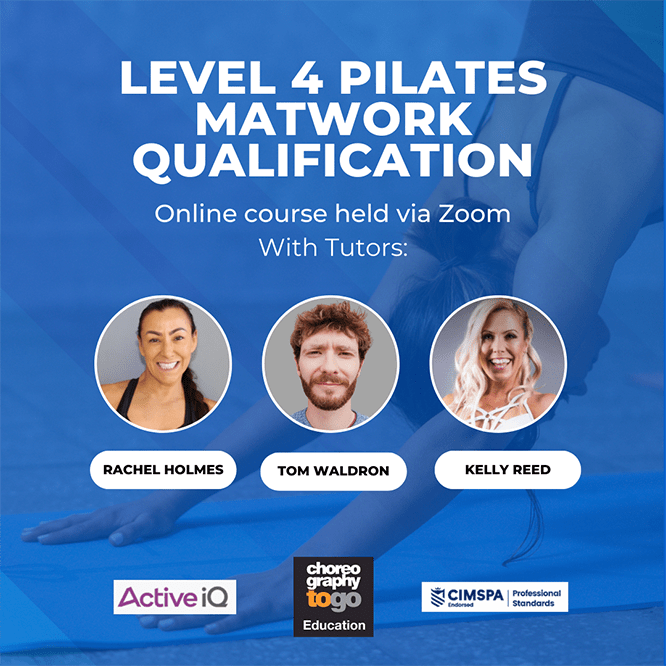

Become and advanced Pilates teacher with our Level 4 qualification, up skill and offer the very best for your pilates clients! International Presenter Kelly Reed

Fitness Pilates Newsletter 23 December It’s been wonderful to see all the videos and pictures of your Candlelight Fitness Pilates classes, as well as some

💡Do you need a rest and reset in January? Treat yourself to our Champneys Luxury Retreat 🥰 Champneys Timetable 17th January 2025⏰ Schedule: 💫8:00 –

🎉 NEW YEAR, NEW CAREER! 🎉✨ Transform Your Passion for Pilates Into a Professional Career in 2025! ✨ 💡 Do you love Pilates?💡 Are you

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672