Fitness Pilates 2025 Class Ideas

FREE COURSES JOIN ME TODAY for 2025 Business Tips for FITPROS on ZOOM FREE – Business Tips Webinar for 2025 sign up here FREE 7

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Can we get Passionate? Rachel

Let’s talk about passion for a few minutes, shall we?

I’m passionate about seeing people move forward and accomplishing their goals.

I’m passionate about helping Fitpros earn the money they should through Fitness Business ideas. Providing them with the tools (class content, choreography business ideas) so they in turn can teach and lead their clients. I’m Passionate about inspiring Fitness Instructors to become amazing role models both physically and mentally. Working with FitPros is my absolute passion.

What’s your passion?

What makes you jump up at 5am in morning to bash out an idea you have had?

It’s important to know what your passion is because you’ll never make the money you really want or have the lifestyle you desire or the clients you crave in something you can’t believe in. For example, if you don’t like Bootcamps or Pilates, or dare I say it Zumba, you shouldn’t build your fitness business involving any of those topics. Even if those models are super fashionable and potentially could make you a lot of revenue.

Your passion, what you’ve been wanting to do forever will actually lead you to not only your ideal client and niche, but it will also lead you to your destiny in many unique ways.

If you have got a burning desire to create your own Fitness Brand, Class, Workout or Programme, or have a burning passion to empower people to lose weight, or enjoy a healthier lifestyle, then don’t spend any more time procrastinating and get a plan together and do it. What on earth is stopping you?

My newsletters and daily positivity emails are all about helping build your confidence, arming you with information which you can use to help your clients, building your community classes, helping you run your business so you can schedule in holidays and taking time out to enjoy life and, as always, I hope you find it inspiring, uplifting and motivating.

The good thing is we are in a fantastic industry that is still in its infancy. Therefore, identify your passion within fitness and run with it and create your dreams and goals

How do you know what your Fitness Health and Wellness Passion is?

Here’s my little test?

So are you ready?

Here are the questions. Please get out your pen

–

#1- What do you always find yourself daydreaming about in relation to your fitness career or business?

#2- Where do you really want to be in 6 months’ time – (anything goes here – be bold and wild here) where do you want to be and to have achieved?

#3- What makes you excited, motivated, encourages you and inspires you within the fitness industry?

Once you really work out what your Fitness Passion is you can then plan out a pathway to get there.

The one person you need to work on the most is yourself, so you are ABLE to speak to your ideal client. To find them, ‘read their mind’ and speak their language, you’ll need to work more on yourself than anyone else.

Your ideal client or market needs you to find your passion! Fire is what people follow and passion is what will help you achieve the fitness business and the life of your dreams.

I’d really love you to tweet me with what you are Passionate about in Fitness – Who do you want to help and serve and create exciting programs for?

And if you feel daring, share with me some of your answers from above as well!

I am passionate about helping you succeed in your Fitness Business! Let’s do this together!

Are you still Time Poor by Rachel x

The most common comment I get on email and face to face with Instructors is “I never have enough time”. This is something I have been looking at and studying over the last few months. There are some fantastic time management books and audios where you can learn the best methods to getting more done in less time, so over the coming weeks I will look at strategies to ensure YOU are making the most of your time.

95% of the things you do every day only 5 % will move your business forward.

Out of everything you do every day only 5% of your tasks will go to moving your business forward. Outsource everything that other people can do and focus on driving your business forward.

Write down a list of you goals – where do you want to be in 6 months’ time or a year’s time?

If you only move your business forward 5% a day it’s going to take forever to get there.

Write a list of everything you do every day in any one given week. Then go through the list and see what you can outsource.

For Example…… A few years ago I was teaching 32 classes a week. Personal Training, working out myself, running my websites, creating workshops and preparing presentations, getting up at 5am to answer emails, being permanently shattered and not moving my business forward.

I could see no way out of this cycle and it was also equal to = No social life, never seeing my friends, trying to get my mum to work for me every day for free, having no partner, getting up at 5am to answer emails and being permanently shattered……..sound familiar?

I desperately needed chunks of time to be able to sit down and get my teeth into loads of projects and ideas I had swimming around in my head.

Make a list of everything you do in a typical day

1.Clean the house

2.Do the Food shopping

3.Do the Ironing

4.Take the kids to school

5.Create choreography workouts

6.Write emails, articles, do social media etc

7.Teach 3 classes

Now out of this list, look at what you can outsource or pay someone else to do

1. Get a cleaner

2. Order shopping online

3. Get an ironer

4. Get a friend to take kids or take it in turns with another parent.

5. Create choreography – you still need to do that yourself!

6. Save all emails you write and set up FAQs on the website or get an assistant

7. Create an online programme and STOP procrastinating on this one

Of course, these things will take time to get sorted and arranged, but think of the time you will have free and be able to move your business forward into the next level of your master plan.

What is your Master plan?

Where do you want to be this time next week? Next month? or Next year?

Are you looking to be a presenter, employ others to teach your Bootcamps or classes or running an online business…..whatever your goals, hopes and dreams are, make sure you take daily steps to edging closer to your goals.

********************************************************************************************

Are you Up for doing more Talks ?

No fitness instructor I know is

frightened of speaking.

We flippin LOVE talking.

It’s the “public” part that is scary.

But why?

You know your stuff.

YOU have a TON Of fantastic info that can help

transform peoples lives.

Tips. Tricks. Amazing research.

You are a TOP professional

with a wealth

of experience

& expertise.

Have you considered doing talks?

You can speak at

Womens groups,

Business groups,

Schools, Colleges,

Universities, Clubs,

Associations,

Professional groups,

Mums Groups,

Parenting groups,

Flower arranging

groups……..

The list is ENDLESS….. I mean endless

Just google around your area

& see what groups

meet & send over a quick

email or Facebook message

There is an unlimited audience

in your town that would

LOVE LOVE to hear a health,

fitness, wellness or nutrition talk.

FROM YOU.

YES YOU.

The Expert.

Public speaking is an

exceptional way of

promoting your business

& your

services.

You may do a talk for FREE

but think of the

great PR &

how many people would

come to your classes,

or buy your personal training

or come to your studio or

purchase your online

products.

The more talks you do.

The better you get.

Be the exceptional expert.

I know you can do it.

Hope that inspires you today.

Detached By Andrew Crawford

Pop went the cork on the bottle of veuve at minutes past midnight…!!

It was the 1st of February. So what??…….

Firstly…it was the end of ‘Dry January’ for some of you and secondly it was the end of the Tax Return season for you as a self-employed business person.

Furthermore…., for Accountants, Bookkeepers, Tax Advisors etc …it was the end of being ‘Detached’.

Detatched from what Andrew?

From reality.

Let me give you an example.

I didn’t know that the radio icon Sir Terry Wogan passed away.

I was completely detached, from media, TV (Tell-Lie-Vision) and the papers. My focus was on the completion and meeting of the 31st January deadline.

Oh….I can give you some stories…….but not today…!!

Oh….OK then…here’s one. (I’ll keep it short.)

It was just gone 10pm….I only had a handful of clients to submit. 4 of us were working very hard,…..when……I stupidly took that ONE call…!!

This call lasted one and a half hours…!!!!

At 20 to midnight, panic struck in…fingers and bodies were everywhere….Zlogg taking the slog out of the Tax Submission process…

BONG……..at the stroke of midnight, my finger pushed the ‘Enter’ button for the final return………..BOSCH……..We had made it…despite being derailed for one and a half hours.

The next detachment was going to be somebodies……………

I was going to tell you about the guy who phone me at 12 midnight asking me “What was the deadline?” or the other one who I sat on the phone with until 4am….!!!

Not sure what your take is on this but human like is created naturally in humans and NOT in a science lab. My good gracious me…they are now artificially creating human life in science labs..!!!

Don’t let me mention about them trying to censor smoking on the big screen..!!

Here’s what a gentleman from North York wrote……I agree totally..

“…….Why stop at smoking? What about alcohol, drugs, unprotected sex, dangerous driving, guns,violence, etc, etc. Maybe we should just ban movies and force parents to wrap their precious little darlings in cotton wool in case they scrape a knee…………”

These people are definitely Detached..!!

So Andrew,

What has detached got to do with Accountancy & Tax?

I believe the Government are detaching themselves from the Entrepreneurial individual and siding with the big corporates. Although I haven’t made an issue of it, the new Dividend rules come into play this year.

One of the benefits of being a Director or a shareholder it the refreshing income of dividends.

Up to now a director could take their personal allowance then top up their income with a dividend of up to £30,000 without paying national insurance or income tax….!!

Detatch.

6 April 2016 all change please.

Further details have been provided of the new rates of income tax on dividends and the new Dividend Allowance which will apply to dividends received on or after 6 April 2016.

The rates of income tax on dividends will be:

There will also be a new Dividend Allowance of £5,000 where the tax rate will be 0% – the dividend nil rate. The Dividend Allowance applies to the first £5,000 of an individual’s taxable dividend income and is in addition to the personal allowance.

Where an individual receives dividend income, from UK or non-UK resident companies, that would otherwise be chargeable at the dividend ordinary, upper or additional rate, and the income is less than or equal to £5,000, the dividend nil rate will apply to all of the dividend income.

Where the dividend income is above £5,000, the lowest part of the dividend income will be chargeable at 0%, and anything received above £5,000 is taxed at the rate that would apply to that amount if the dividend nil rate did not exist.

In calculating the tax band into which any dividend income over the £5,000 allowance falls, savings and dividend income are treated as the highest part of an individual’s income. Where an individual has both savings and dividend income, the dividend income is treated as the top slice.

The following example illustrates how the new Dividend Allowance and rates will work:

Patricia has a salary of £40,500 and dividend income of £7,000 in 2016/17. Her total income is therefore £47,500. The total of her personal allowance and basic rate band comes to £43,000. Therefore part of her dividend income would be taxed at the upper rate were it not for the operation of the new dividend nil rate.

So £5,000 will be taxed at 0% and £2,000 will be taxed at the upper rate of 32.5%

Finally

If you have loads of paperwork and you produce a lot of invoices, you can try Zlogg. This is a new accounting software launched a few months ago

Try it for FREE for 30 days : www.zlogg.co.uk

If you need an alternative because your tax affairs are simple then there is Quick Zlogg. This is an online Tax Return service only.

Visit the site here : www.quickzlogg.co.uk

Look forward to seeing you at the forthcoming events.

Real Recognises Real – AJC

Andrew James Crawford

FREE COURSES JOIN ME TODAY for 2025 Business Tips for FITPROS on ZOOM FREE – Business Tips Webinar for 2025 sign up here FREE 7

NEW QUALIFICATION LAUNCH🌟 What is the Level 3 Diploma in Supporting Participation in Physical Activity: Long-Term Health Conditions? 🌟 🚀 Starts January 2025! 🚀💡 Live

🤩Hear from Tutor Kelly all about our first Fitness Pilates training course coming up January 3rd 2025 💻 Want to learn about our teacher training

🎉 NEW YEAR, NEW CAREER! 🎉✨ Transform Your Passion for Pilates Into a Professional Career in 2025! ✨ Our first course date of 2025 is

January 2025 is PILATES Education Month We have ALL the courses running in January BOXING DALE COURSE SALE Fitness Pilates Teacher Training 3rd January Level

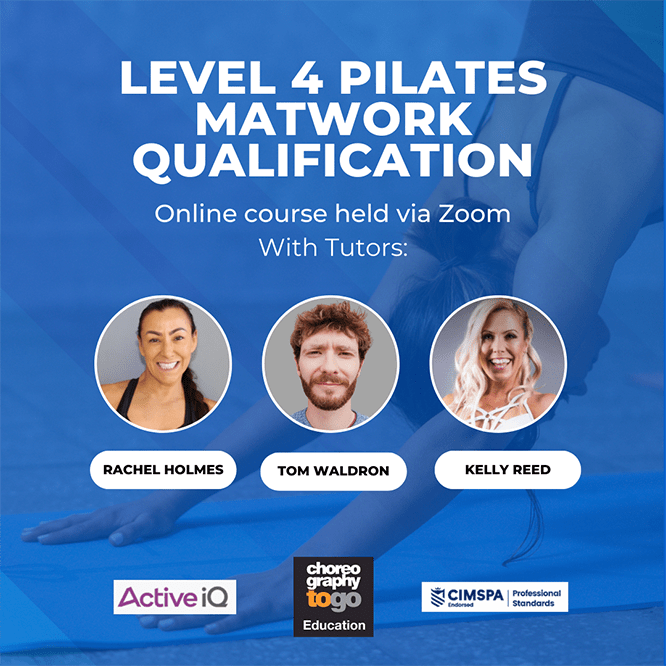

Become and advanced Pilates teacher with our Level 4 qualification, up skill and offer the very best for your pilates clients! International Presenter Kelly Reed

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672