Another Big Achievement at Choreographytogo This Week!

Another Big Achievement at Choreographytogo This Week! We are thrilled to celebrate Helen Wilson and Sue Wakefield, who have officially become the first-ever certified Fitness Pilates

My bags are packed.

Food is prepped.

Routines & music all planned.

Spray tan, hair & nails all done

(It’s a full time job

just getting out of the door!)

and we hit the road for

glorious Blackpool & The International Fitness showcase.

I’ll be vlogging & tweeting, Instagramming & Facebooking the whole experience.

I’m really looking fwd to the

whole extravaganza.

If you are attending do pop over & say HI.

I LOVE to see C2GO’ers & KSFL’ers.

Abdominal Evolution Tour with Kelly

If you are keen to jump on this

tour most venues are

now full.

Check the booking page for the venue you would

like to attend.

Click here

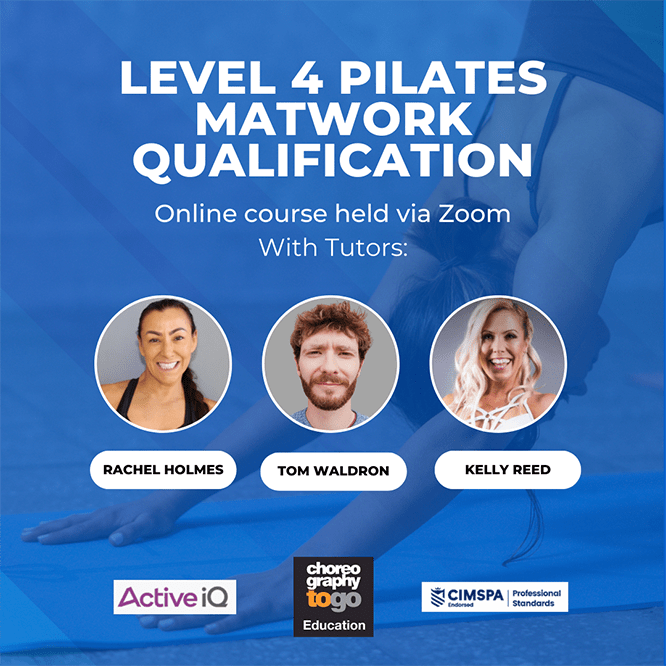

Fitness Pilates Training

The demand for training is

incredible right now.

There are 2 places left on

the next course in

18/19 April in Derby.

Click here to book.

Music

I cannot get enough up of Uptown Funk

& Dance Overdrive from Pure Energy

Check them out.

Are you on my Kick Start mailing list?

For all the recipes, nutrition, fatloss,

home workouts & motivation click here

Have You Got Teens?

I have a prototype online healthy teens

programme coming up. With workouts,

nutrition, cooking, baking, self esteem

& motivation.

Have you got teens that may be interested in

trialling the programme with me?

If so head over to my Kick Start Fat Loss

Facebook page and register your interest over there.

Quick Recipes

Super Juices – Nutri Bullet Ideas Click here

Ginger, Goji berry Raw Chocolate Click here

Enter the new age of Marketing – Visual Marketing

Check out these stats:

Every MINUTE

208,300 photos are uploaded onto FB

?27,800 photos are uploaded to Instagram?

100 hours of video is uploaded to YouTube

* Pictures speak louder than words. We think in pictures.

* Average adult attention span is between 3 – 8 seconds.?

* 90% of information transmitted to the brain is visual .

* Visuals are processed by the brain 1000’s of times faster than text .

We are reaching information overload and visual marketing?is becoming one of the most effective ways to market our?fitness services on social.

This is a dream for the discerning Fitpro as our job is so visual.

Making images and visuals an important piece of your fitness marketing mix on social.

Facebook is showing more images in the newsfeed so it’s advantageous foryou to create vibrant visuals for your classes.

How Do YOU create powerful visuals for Facebook?

The easiest way I find is to use PICMONKEY

http://www.picmonkey.com/?

You can download cool graphics and add funky text on top in a matter of minutes.

You don’t have to be a super duper graphic designer to create exciting,motivating and vibrant visuals, images that promote your classes, yourBootcamps, Your PT and everything you offer.

The cooler the graphic the more likes, shares and comments you will get, which equals more exposure in the newsfeed.

I look forward to seeing your graphics and visuals on Facebook this week.

The Power of a Positive NO! ?By Jenny Burrell www.burrelleducation.com

These two letters give so many people so many problems….here are some thoughts on the Power of No!

1:If you say YES when you mean NO, eventually it will bite you! You WILL eventually have to say that NO.

2:Saying NO to others usually means saying YES to what you want and it’s OK to want what you want because that’s what the other person wants….they want what they want. Get it?

3:Say no with a smile…..try ‘Oh gosh NO I can’t at the moment (smile), my diary is mad busy – how about next month?’

4:Pass it over to someone else….try ‘No, I can’t help, but………I think I know someone else who can’ (smile).

5:Realize that some people have poor boundaries and they think that what they want from you is their right – WRONG! You are serving the world when you put them straight, LOL!

6:Realize that most people can and should figure it out for themselves as that’s how you learn best…..again, you are serving the world when you help them out with that one.

7:Realize that if you say YES because you fear people disliking you…..guess what…..people will still dislike you – FACT! They will find something else that displeases them. So saying YES isn’t a guaranteed way to make people like you.

8:Learn to LOVE NO! No to others (try to do this without malice/resentment) is YES to what feels right for you and your life and that key concept should NEVER be sacrificed. Run your own life, do what suits you best and when it doesn’t suit others, don’t take it personally that they get upset with you, we all want what we want……

Say YES to this…..and join my inspirational Women On Fire Event in April

Total Eclipse

By Andrew Crawford

Break out those dark glasses because tomorrow morning there’s going to be a partial eclipse.

Warning…….

It is not safe to directly view an eclipse even with dark Gucci shades…!!!

So Andrew….

What has Friday’s Partial Eclipse got to do with Accountancy and Tax?

Well…….

Last night’s budget announcements were designed to Eclipse all the negative press the Government has been under lately (trying to sweep it under the carpet) plus it’s meant to blind you like the eclipse just BEFORE the elections….!!

Talking about the budget, I thought I would cover a few points of interest that may or may not impact on you and your business.

Main Budget tax proposals

Increased personal allowances

The introduction of a new Personal Savings Allowance

Changes to ISAs including the introduction of a new type of ISA for First Time Buyers

Changes to pensions

Potential business rate reform in England

Entrepreneur’s Relief – changes to qualifying conditions

Personal Tax

The personal allowance for 2015/16

For those born after 5 April 1938 the personal allowance will be increased to £10,600. For those born before 6 April 1938 the personal allowance remains at £10,660.

Tax bands and rates for 2015/16

The basic rate of tax is currently 20%. The band of income taxable at this rate is being decreased from £31,865 to £31,785 so that the threshold at which the 40% band applies will rise from £41,865 to £42,385 for those who are entitled to the full basic personal allowance.

The additional rate of tax of 45% is payable on taxable income above £150,000.

Dividend income is taxed at 10% where it falls within the basic rate band and 32.5% where liable at the higher rate of tax. Where income exceeds £150,000, dividends are taxed at 37.5%.

Class 2 National Insurance contributions (NIC)

From 6 April 2015 liability to pay Class 2 NIC will arise at the end of each year. Currently a liability to Class 2 NIC arises on a weekly basis.

The amount of Class 2 NIC due will still be calculated based on the number of weeks of self-employment in the year, but will be determined when you completes your self-assessment return.

It will therefore be paid alongside their income tax and Class 4 NIC. For those who wish to spread the cost of their Class 2 NIC, HMRC will retain a facility for you to make regular payments throughout the year. The current six monthly billing system will cease from 6 April 2015.

Those of you profits below a threshold will no longer have to apply in advance for an exception from paying Class 2 NIC. Instead you will have the option to pay Class 2 NIC voluntarily at the end of the year so that they may protect their benefit rights.

The government has announced that Class 2 NIC will be abolished in the next Parliament and will reform Class 4 NIC to include a contributory benefit test.

Starting rate of tax for savings income

From 6 April 2015, the maximum amount of an eligible individual’s savings income that can qualify for the starting rate of tax for savings will be increased from £2,880 to £5,000, and this starting rate will be reduced from 10% to 0%.

These rates are not available if taxable non-savings income (broadly earnings, pensions, trading profits and property income) exceeds the starting rate limit.

Transferable Tax Allowance

From 6 April 2015 married couples and civil partners may be eligible for a new Transferable Tax Allowance.

The Transferable Tax Allowance will enable spouses and civil partners to transfer a fixed amount of their personal allowance to their spouse. The option to transfer is not available to unmarried couples.

The option to transfer will be available to couples where neither pays tax at the higher or additional rate. If eligible, one partner will be able to transfer 10% of their personal allowance to the other partner which means £1,060 for the 2015/16 tax year.

The personal allowance and tax bands for 2016/17 and beyond

The personal allowance will be increased to £10,800 in 2016/17 and to £11,000 in 2017/18. The Transferable Tax Allowance will also rise in line with the personal allowance, being 10% of the personal allowance for the year.

The higher rate threshold will rise in line with the personal allowance, taking it to £42,700 in 2016/17 and £43,300 in 2017/18 for those entitled to the full personal allowance.

Personal Savings Allowance

The Chancellor announced that legislation will be introduced in a future Finance Bill to apply a Personal Savings Allowance to income such as bank and building society interest from 6 April 2016.

The Personal Savings Allowance will apply for up to £1,000 of a basic rate taxpayer’s savings income, and up to £500 of a higher rate taxpayer’s savings income each year. The Personal Savings Allowance will not be available for additional rate taxpayers.

These changes will have effect from 6 April 2016 and the Personal Savings Allowance will be in addition to the tax advantages currently available to savers from Individual Savings Accounts.

The end of tax deduction at source on interest

Due to the changes to the starting rate for savings and the introduction of a Personal Savings Allowance, many individuals will no longer need to pay tax on their savings income. Currently, 20% income tax is automatically deducted from most interest on savings excluding ISAs.

From April 2016, the automatic deduction of 20% income tax by banks and building societies on non-ISA savings will cease.

Corporation tax rates

From 1 April 2015 the main rate of corporation tax, currently 21%, will be reduced to 20%.

As the small profits rate is already 20%, the need for this separate code of taxation disappears. The small profits rate will therefore be unified with the main rate.

It is proposed that the rate of corporation tax will continue at 20% for the financial year beginning on 1 April 2016.

Annual Investment Allowance (AIA)

The AIA provides a 100% deduction for the cost of most plant and machinery (not cars) purchased by a business up to an annual limit and is available to most businesses. Where businesses spend more than the annual limit, any additional qualifying expenditure generally attracts an annual writing down allowance of only 18% or 8% depending on the type of asset.

The maximum annual amount of the AIA was increased to £500,000 from 1 April 2014 for companies or 6 April 2014 for unincorporated businesses until 31 December 2015. However it was due to return to £25,000 after this date. The Chancellor announced that following conversations with business groups this would be addressed in the Autumn Statement and would be set at a much more generous rate.

Digital tax accounts

The government has announced some initiatives to ‘transform the tax system over the next Parliament’ by introducing digital tax accounts and removing the need for annual tax returns. A digital tax account will enable individuals and small businesses to see and manage their tax affairs online. As a first step, the government will:

publish a roadmap later this year setting out the policy and administrative changes needed to implement this reform

introduce digital tax accounts for five million small businesses and the ten million individuals by early 2016.

For the FULL Budget breakdown go here……….

http://www.fitnessindustryaccountants.com/ard/documents.asp?AID=1987&SID=11&FID=37249

Finally

Sorry my article was full of facts and figures, sometimes it’s gotta be like that.

Hopefully I will catch up with some of you in Blackpool at IFS tomorrow night.

Until then…………Keep Your Light Shining to Totally Eclipse the Darkness..!!

Andrew James Crawford

Another Big Achievement at Choreographytogo This Week! We are thrilled to celebrate Helen Wilson and Sue Wakefield, who have officially become the first-ever certified Fitness Pilates

Good Morning Team! I hope the snow hasn’t disrupted your classes too much this week! It’s been incredibly heavy here in Derbyshire, which reminds me—it’s always

We are thrilled with the messages coming in from our Fitness Pilates Summit Event THANK YOU to all of you wonderful people 🥰 We can’t

We are proud to announce that our Fitness Pilates Reformer Certification is endorsed by National Governing Body EMDUK ✅OUR NEXT COURSE is running on Friday

PRESS RELEASE Big Achievement: First Graduate of the Fitness Pilates Reformer Course. We are thrilled to announce that our very first learner, Helen Wilson, Helen

Launching the new YMCA Level 3 Award Menopause Qualification Be the first in the UK to gain your Level 3 Menopause Practitioner qualification. Delivered online via Zoom,

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672