New Class Choreography Packages for Fitness Pros

We have launched 3 new packages for fitpros looking for some inspiration for their Spring class timetables! Whether it be launching a new class or

More Future Trends and Predictions

I LOVE doing a future trends and predication articles about this time of year, these are only my ideas do let me know what you agree?

Online – I KNOW I keep on saying it & writing about it

Is only just getting started: online training, live classes, googlehang out, creativelive, ustream in fact tons of portals where you can hold online courses and live classes and this is set to explode in 2015.

The internet is evolving rapidly as we head into the next phase which is called Web 3.0, now I’m not even going to pretend I understand exactly what Web 3.0 is but you can be sure as dammit the internet and social media is playing a bigger and bigger role in all of our lives and this will cut across all industries, sectors and businesses.

My gold nugget advice to ALL fitness instructors, personal trainers, Bootcampers and SGT if you want to move with them times is to get web savvy, do some research and learn simple skills to develop your businesses and brands.

WE all know face to face teaching has a limited earning potential because you are always swapping time for money, of course you could go down the route of employing people but its well documented that path can be fraught with issues so leverage YOU and your services online.

Mobile – This has been a predication for that last few years and its here and its totally arrived. The way we view the internet is getting smaller, iphones and the new ipad mini allow us to have the internet with us at all times. Consumers are not buying desk tops they are buying smart phones and tablets.

My own Kick Start Online programme is a perfect example, with its daily workouts, sound cloud audios and real time social media support most members are accessing KSFL on their smart phone. When I surveyed my members the majority of tuning in on smart phones and tablets.

Live Classes – We are definitely in that “whats happening next” kind of cycle with group X. Big brands are settled into being the norm and everyones looking for the next “big thing”…. so create it?

I’m backing HOT classes for 2015 as being HUGE.

Be the trend setter not the trend follower survey people, talk to them live and on social media. Look back into the past for future inspiration.

I’d love to know your predications. Tweet me @RachelHolmes

What’s On my Playlist this week.

LOVING 🙂

Chartbreakers 11 – Its a definite grower as it’s quite clubby, but after a few plays you are hooked. It has a funky fresh vibe & I’m loving it right now perfect for Tabata training.

Pure Dance – a new one just released by Pure Energy & again a really uber cool upfront vibe. Ideal for HiLo & Conditioning classes

Check these out on the Pure Energy Digital Website

After researching countless hours since the introduction of Facebook adverts I’ve put together a comprehensive

video training course aimed at Fitpros who want to use Facebook adverts but feel lost & not really sure how to do it.

I run multiple Facebook adverts every day to grow my email list, drive leads & traffic to my website & promote live classes course & events. I find them to be amazingly effective.

Back in the day, I used to spend hundreds even thousands of £’s on flyers, mailshots & newspaper adverts to get a small % return.

Now, with Facebook adverts you can spend as little as £5 – £10 to see exactly what works and precisely target the right market for your products, classes & services.

There is a knack to it. Testing the right text, the right graphics & having the right structure in place is key to success and once you understand that you’ll start to get great results.

In the course I show you exactly step by step how to do it.

You will need your own website to implement the strategies right away.

I’m doing a special Facebook Adverts for Fitpro pre launch price of £57 for readers of the C2GO newsletter before I do a the big launch next week so if you are keen to move ahead Click here for all the details

KS EXTREME London 29th November

Do you need fresh, exciting & innovative ideas for your HIIT workouts?

Do you need some fresh HIIT & interval music?

Kelly & I will be presenting the final KS EXTREME workshop date

at the London Reebok Sports Club in Canary Wharf so book on and come down to have a blast on this awesome workshop day.

HOT FITNESS PILATES

Hot studios are popping up everywhere. All over the UK entrepreneurs are spotting this trend with the growth of HOT YOGA & Bikram studios & studio owners are looking for more Hot classes for their timetables.

We have spent months researching, testing & creating our brand new Hot Fitness Pilates course which is happening in Nottingham at Go To Hot Yoga on 5/6 December.

The enquiries & interest has been intense & I foresee HOT classes being a major trend in 2015.

To book onto the course click here for details.

Stepping Away From BUSY

By Jo De Rosa

Last week my computer died.

As you can imagine I freaked out.

How was I going to do my emails?

How was I going to write my blogs?

How was I going to update my website?

How was I going to do all the things I normally do in my office all day?!

I was lost.

And annoyed.

So I went off and had a bath…..to sulk……and mull it all over.

The next morning I woke up refreshed and renewed, and knew that of course this was happening for a reason and I should ‘go with the flow’ of it (as I teach others to do!)

I thought about all the things I needed to ‘do’ and asked myself,

“What would happen if I didn’t do any of them this week?”

And in that moment I realised that nothing was going to happen!! Everything would be ok. And it was time to ‘BE’ rather than ‘DO’.

I’ve been struggling to get my own practice of yoga and meditation to fit in to my busy schedule for a number of months now. It’s like I’ve just got ‘out of the habit’ of doing it, that there were so many other things that were much more important. And when I let my own practice slide, everything else starts to go the same way: everything gets more difficult and life feels like it needs oiling!

Meditation is that oil for me, and so I dedicated last week to finding myself again.

The emails had to wait and I included apologies when they finally went out this week (a pretty good excuse of no computer), and everyone totally understood.

Facebook, Twitter, newsletters, blogs, and website updates were all still there this week when I returned to my office.

And I stepped away from my latest addiction too: social media.

When did being busy become so trendy? Everyone is busy! No one seems to say,

“Oh I wish I had more things to do”

But this way of living is not good for us! We should make time for relaxing, bathing, walking, gardening, painting, meditating or whatever connects us back to ourselves.

How on earth can we expect to run optimally when we don’t make space for our mental health? By running ourselves into the ground day by day, hour by hour, minute by minute, we are perhaps creating the right environment for depression, low self-esteem, and dis-ease. It is OUR responsibility to step aside and get some clarity on HOW we live our lives.

And if we have children, it is our responsibility to show our children how important it is to have space away from social media, what we feel we ‘should’ do, and the constant barrage of outside stimulation.

Are we assuming that by running ourselves into the ground that somehow something is going to change all by itself – NO – we must take back control and step into a place of choice. Choosing to ‘fill ourselves up’ with what makes us well oiled and evolving consciously.

So I have a few new rules in my world, put into place this week:

1) Meditation gets done in the morning BEFORE ANYTHING ELSE because it is the most important thing in my life. If I have an early appointment, I will GET UP EARLIER THAN USUAL. Within my meditation practice I set my intentions, and doing this first thing is beautiful as EVERYTHING that then happens through the day comes from this connected open space.

2) My days are planned THE EVENING BEFORE with a list. I ONLY do things that are on the list, unless something so important and exciting crops up that I simply cannot not do it. Once I’ve completed everything on the list for that day I don’t add any more, I GO AND HAVE SOME FUN!

3) I turn social media OFF when I am writing blogs/copy so that I do not get distracted with that evil bleep whenever you get a facebook notification!

4) My mobile phone no longer comes in the bedroom with me (constant facebooking in bed is sooooo unsexy!). It gets charged in my office overnight, and our bedroom is now purely about sleep and sex!

5) ALWAYS BACKING UP MY COMPUTER lol! I was really lucky that I didn’t lose anything, but I thought I had, and it was a hairy few days….i’m not going there again!

There is no reason I need to know about ‘work’ stuff until I have completed my morning practice. And my brain likes this organised ‘filing’ system of work/life balance 🙂

It’s hard when you are self-employed to not work your ass off all the time, especially when teaching in the evenings and at weekends. But it is VITALLY important to relax, breathe, look up from your computer screen now and again, and connect with family, nature and self.

It’s great now that my computer is back. But I am very thankful for last weeks disaster, and the perspective it has given me. I’m also feeling super grateful that I am who I am, not trying to be anything else, and doing the very best that I can. No one can ask for more than that xx

I’m travelling up to Birmingham this weekend for the Ignite! conference organised by Damsels In Success. For all of the ladies out there this is going to be a truly inspirational event! Some of the speakers are: Janey Lee Grace, Michelle Ghilotti, Dr Joanna Martin, Carly Hope and Dan Bradbury.

If you can get yourself there you will not be disappointed: fantastic speakers, incredible content, and I have been listening to the recordings of last years 2 day event all year.

www.damselsinsuccess.co.uk/ignite2014

I stepped up and entered a competition to speak too, WHICH I WON!!! So you can catch me sharing my own transformational story on stage in front of hundreds of people (my biggest speaking gig yet). I cannot tell you how EXCITED I am to be sharing the stage with so many inspirational speakers!!!!!! I also have a table all weekend so if you book up to come please do come and say hello!!!

Have a great weekend y’all and do get in contact to tell me how ‘busy’ you’ve been! xx

Web: www.innerguidance.co.uk

Email: jo@innerguidance.co.uk

Facebook: InnerGuidance

Twitter: @Inner_Guidance

Copyright: Jo De Rosa 2014

R(EVOL)UTION

By Andrew Crawford

If a peaceful protest was planned, why did so many students arrive with their faces concealed with masks and scarves??

Thousands of students marched through the capital yesterday protesting against student fees, nuclear weapons and war in the middle east.

The organiser said

“We want to end the lifetime of debt which is a massive burden for students.”

“Students are really angry because we go to university and then at the end of it we get an average of £40,000-worth of debt. That puts you in a hell of a difficult position when you start to think about a mortgage and a family. We need an alternative.”

To be honest, the fees are a little high…. Especially if you remember them being FREE and the pupils also got a grant from their local councils for living expenses.?

It also doesn’t make sense.

These kids are debt ridden BEFORE they even start work…….what kind of lesson is this teaching them??

When I say free, they were paid for out of our Poll Tax (if you can remember that tax before the council tax hit us….Boom…!!).

And in other news……far away downunder in bushes frequented by well known personnel… one can hear this sentence…

“………Even a murderer gets fed 3 times a day…!!……”

I say….. ‘…you knew the consequences and conditions to expect before you accepted the 6 figure fee, it wasn’t a surprise, why did you go into there in the first place??….You owe us more than just 3 days..!!!??..’

So Andrew

What has the student revolt and the east London reality star got to do with Accountancy and Tax?

Well…one owes money…the other owes time…….we are talking about …Debt…!!!!

Debt is really just a simple concept, which provides that a person who borrowed something from another is duty bound to pay that debt.

However, the concept of debt becomes more complicated with the introduction of other concepts like mortgage, interest rates and other charges. Interest makes most debts double or even triple in amount. More often, the interest rates due for a certain debt is even higher than the principal amount borrowed.

A person who borrows money from another is said to be in debt. The debts of a person can be minimal or can reach up to millions depending on the credit limits of each person.

A person who wants to get credit can do so in the form of a loan. This is the exact position we have with our students.

A loan can either be secured to unsecured. A secured loan means the debtor borrowed some money and supported the loan by collateral or a security for the loan. The security or collateral can come in the form of a house and lot, a car or any asset of the debtor. An unsecured loan means otherwise.

Most creditors require a security before granting a loan because it gives them something to hold on to or to forfeit in case the debtor defaults in payment.

When the debtor fails to pay the debt within the agreed timeframe then the creditor can foreclose the security or the collateral.

However, having an unsecured loan doesn’t mean that the debtor can renege on his debts. When the debtor fails to pay his loans, the creditor can still run after him by filing a case in court. When this happens, the debtor who has no cash can sell some of his assets to pay for his outstanding loan.

Being in debt is common even for the rich and the famous; the only difference between them and the common people is that their debts can be in the millions since they have more assets to support their loan. Unsecured loans most often have higher interest rates to make up for the lack of security.

Even third world countries are indebted to more developed countries. However, the debts of a country can go on forever because they keep on paying their loan but they also get new credits as their credit ratings go up.

How to take charge of your debts

The rising cost of living, dying and schooling has made people more reliant on loans and credit. Most people have been indebted to someone at some point in their lives. I was…when I was issued with the ‘Credit Card’.

Being in debt is normal considering that no one has a monopoly of all the money in the world. People will always have the tendency to accumulate debts no matter how rich. In fact, rich people have more debts than poor people because they have more needs and they have more collateral or security.

Being indebted isn’t something that you should be ashamed of provided you are a responsible debtor. This means that you used the money for a very good cause or purpose.

Even a person who is savvy in financial management can get into debt for one reason or another. However, a person who is good in managing their finances should also be good in managing their debts.

Managing debts would include the ability to know how much you owe and from where you would get the money to pay such debts.

There are people who don’t practice good debt management and they keep borrowing money without being able to monitor how much they already owe.

Debt management means that at the time the loan was made, you being the borrower would know where you would source the payment for the debt. This makes the debt manageable because it would appear that you have some source of income and was just not liquid at the time you borrowed the money.

People who don’t have a steady source of income should be discouraged from borrowing because there is a tendency for their debts to pile up without being paid at all.

Unemployed people who resort to borrowing for their essential expenses like food and daily subsistence may borrow from another creditor to pay off a debt that is already due and demandable. The same thing happens to the second and the next loans after which it becomes a vicious cycle.

Debts are easily made but they are difficult to pay. Thus, every person should be careful when borrowing money from others. Make sure that you have something to pay for the debt like an incoming income or assets that can be sold to pay off the debt.

Some people get indebted by virtue of loans that have varying interest rates. This means that aside from the principal amount borrowed, the debtors still have to pay for the interest rate. A person who borrowed £100 at ten percent interest rate per month will have to pay the principal plus the interest rate of £10 per month. Some interest rates are based on the actual balance like if the debtor has already paid £20 then the interest rates would only be pegged on the balance of £80. However, there are some interest rates pegged at the original amount borrowed.

While being in debt is prevalent, every person should learn how to manage their debt and how to stay out of debt if possible. One of the major factors why most people are indebted today is the misuse of the plastic……..credit cards.

Credit cards are those plastic cards that can be used to pay for almost any purchase even if you don’t have cash. People find it easier to spend when using their cards because they just swipe it and voila—-it works like a genie granting their every wish!

However, most people who fail to use their credit cards wisely become indebted and are faced with legal actions for failing to pay their cards when they become due and demandable.

Go ahead, borrow if you must but always take charge of your debts to make sure they don’t lead you to declaring insolvency or bankruptcy.

…………And breathe……….

Finally

I missed our Katie tonight as I was at a 6th Form meeting with my daughter.

Hey…..each school head was trying their best to sell the school and its virtues to us. Why? Because I know that each child in attendance ‘attracts’ certain funding and budget for the school. The more pupils they have, the more funding they get……funny how they didn’t mention that eh??

Condolences go out to Jimmy Ruffin who past today.

Andrew James Crawford

We have launched 3 new packages for fitpros looking for some inspiration for their Spring class timetables! Whether it be launching a new class or

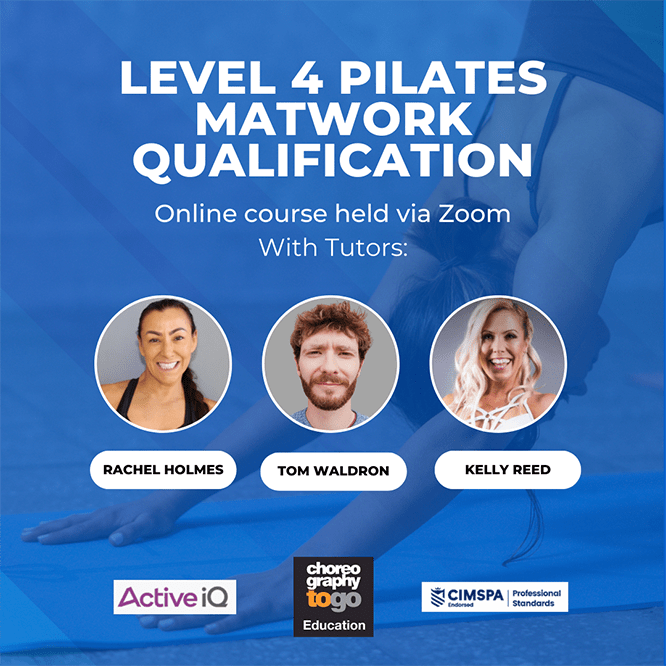

Wow what a weekend we have just had for IFS 2025, did you come along? I can’t wait to see you next year already… 📢Here

Get all my notes from IFS 2025 Blackpool click here Check out the 12 weeks FITPRO membership to STUDIO LIVE for daily choreography here Get

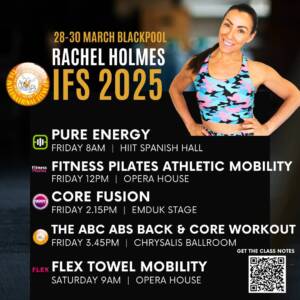

😊Hey are you going to IFS 2025 Blackpool ?! 28-30 March We hope to see you there!👋 The C2GO team will be teaching a great

Fitness Pilates Teacher Training Comes to Saudi Arabia! We are absolutely thrilled to announce that The Fitness Pilates Training Course is coming live to Saudi

🎉 Fitness Pilates Summit 2025 – Official Timetable Launch! 🎉 🗓️ Saturday 20th September | 📍Nottingham We are beyond excited to officially launch the 2025

For all events booking enquires and qualifications information contact:

rachel@choreographytogo.com

Office Number 07976 268672